- Author: Raymond

- Category: Medical Insurance in Kenya

Top 10 Best International Medical Insurance Companies Operating in Kenya — And How They Compare to Kenyan Medical Insurers

Kenya’s health-insurance space is wild right now — global giants are landing, local insurers are levelling up, and customers just want one thing: a medical cover that actually works when life gets messy. Whether you’re an expat in Nairobi, a Kenyan working abroad, a business traveller, or a family that simply wants global-quality care, the question stays the same:

Who gives the best medical insurance — international providers or Kenyan insurers?

Let’s break it down like humans who’ve lived through hospital queues, unexpected bills, HR silence, and the chaos of medical emergencies.

Why International Medical Insurance Is Trending in Kenya

Because people want:

- Worldwide hospital access

- USD-based coverage

- Premium maternity limits

- Chronic & cancer care without drama

- Evacuation & repatriation

- Fewer approvals

- Faster reimbursement

- Flexibility for business travellers

Search volumes don’t lie — Kenyans are googling phrases like:

“Best international medical insurance Kenya”,

“Global health insurance Nairobi”,

“Bupa vs Cigna Kenya”,

“Affordable international health cover Kenya,”

because the hunger for better health outcomes is real.

Top 10 International Medical Insurance Companies in Kenya

These companies actively serve clients in Kenya through agencies, brokers, and partner hospitals.

1. Bupa Global

Bupa is the Beyoncé of global medical insurance — premium, polished, and pricey.

What they offer:

- Worldwide inpatient & outpatient

- Direct access to top hospitals (Europe, UAE, USA optional)

- High maternity limits

- Chronic conditions

- Evacuation & repatriation

Why Kenyans love it:

Fast approvals, global reputation, and fewer exclusions (depending on plan).

2. Cigna Global

Smooth, corporate-friendly, and flexible with modular plans.

Highlights:

- Worldwide treatment

- Strong chronic disease management

- Employee assistance programs

- Mental health support

- Multiple currency options (USD preferred)

Best for:

Expat families, multinationals, and digital nomads based in Kenya.

3. Allianz Worldwide Care

Think of strength, stability, and borderless access.

What they deliver:

- Euro-backed policies

- Wellness benefits

- International evacuation

- Travel add-ons

- Strong cancer care limits

Why it's popular:

High global hospital acceptance + excellent digital service.

4. Aetna International

A favourite among corporates operating across Africa.

What they offer:

- Extensive global hospital network

- Maternity care

- Chronic & congenital conditions

- Preventive checkups

- Employee wellness

Good for:

Kenyan companies with staff stationed abroad.

5. Momentum Health (South Africa)

Regional giant with competitive pricing.

They provide:

- Regional + global plans

- Maternity

- Oncology

- Dental/optical

- Chronic disease cover

Why Kenyans buy it:

Cheaper than Europe/US-based insurers but still international-level.

6. Hollard International

Known for affordability + good value.

Benefits include:

- Global inpatient

- Optional outpatient

- Dental, optical, maternity

- Emergency evacuation

Trending because:

Budget-friendly compared to Bupa or Cigna.

7. Now Health International

Their whole vibe is “fast, digital, responsive.”

What you get:

- Worldwide medical cover

- Quick claims via app

- Strong cancer & chronic cover

- High limits

Most loved by:

Young professionals and frequent travellers.

8. William Russell

Simple, boutique-style health insurance.

They offer:

- Maternity

- Mental health

- Dental + eye

- USD/GBP/EUR plans

Perfect for:

People who want international cover without corporate complexity.

9. IMG Global

If you need value but still want global protection.

Features:

- Good for students, travellers, families

- Emergency care

- Affordable USD plans

- Telemedicine options

Why it trends:

Best entry-level international health insurance.

10. AXA Global Healthcare

Reliable, global and loved by multinationals.

They offer:

- Worldwide access

- Evacuation

- Routine care

- Chronic conditions

- Digital docs

Who buys it:

Corporate staff working across continents.

How International Medical Insurance Compares to Kenyan Medical Insurance Companies

Let’s get real — Kenyan insurers have improved a lot, but the gap is still visible in these areas.

1. Hospital Access

- International insurers:

Global hospitals + VIP networks + direct billing abroad. - Kenyan insurers:

Strong local networks; limited global coverage unless on premier corporate plans.

2. Coverage Limits (Especially Maternity & Chronic Care)

- International:

Maternity up to USD 10,000–25,000+.

Chronic care: smooth approvals. - Kenyan:

Most plans offer KSh 150,000–300,000 maternity.

Chronic limits depend on provider; approvals can delay.

3. Pre-existing Conditions

- International:

Some offer coverage after waiting periods or loading. - Kenyan:

Mostly exclusions unless corporate or high-budget plans.

4. Premiums

- International:

USD-based = expensive but premium service. - Kenyan:

Affordable options from as low as KSh 10,000 per year.

5. Evacuation & Repatriation

- International:

Always included. - Kenyan:

Mostly add-ons.

6. Customer Experience

- International:

Seamless digital service + fewer disputes. - Kenyan:

Improving but sometimes slowed by approvals and paperwork.

So… Which One Should You Choose?

If you want:

- Global access

- Premium maternity

- Global specialists

- Worldwide evacuation

- Stable USD cover

Go for international medical insurance.

If you want:

- Affordability

- Local networks

- Easier outpatient use

- Flexible family packages

Choose Kenyan medical insurance.

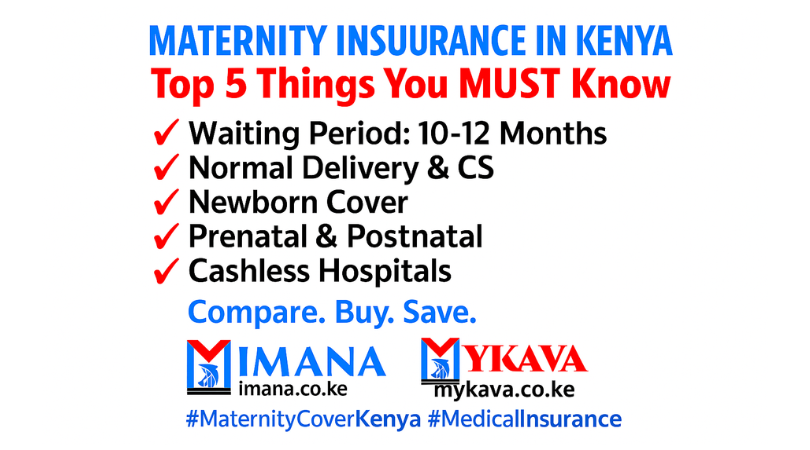

And the best part? You don’t have to guess or gamble — Imana Insurance and MyKava Online Insurance Shop compare quotes for you for FREE.

Where to Compare & Buy Medical Insurance (Kenya + International)

👉 Imana Health Insurance Quotes:

https://imana.co.ke/insurance/imana-health

👉 MyKava Health Insurance Quotes:

https://imana.co.ke/insurance/health-insurance

👉 Micro Health Cover:

https://imana.co.ke/micro-quote

👉 Talk to an advisor via WhatsApp: +254 796 209 402 or +254 745 218 460

Whether you're buying for a family, SME, corporate, or you're eyeing that international upgrade — we help you compare, save, and buy smarter.

Looking for us on Google? Just type.....

- Best international medical insurance Kenya

- Top global health insurance companies Nairobi

- Bupa Kenya vs Cigna Kenya

- Affordable global medical cover Kenya

- Kenya medical insurance comparison

- International health cover for expats Kenya

- Best medical insurance for maternity Kenya

- Medical insurance quotes Kenya online

- Private health insurance Nairobi