- Author: Raymond

- Category: Medical Insurance in Kenya

Looking for affordable maternity insurance in Kenya?

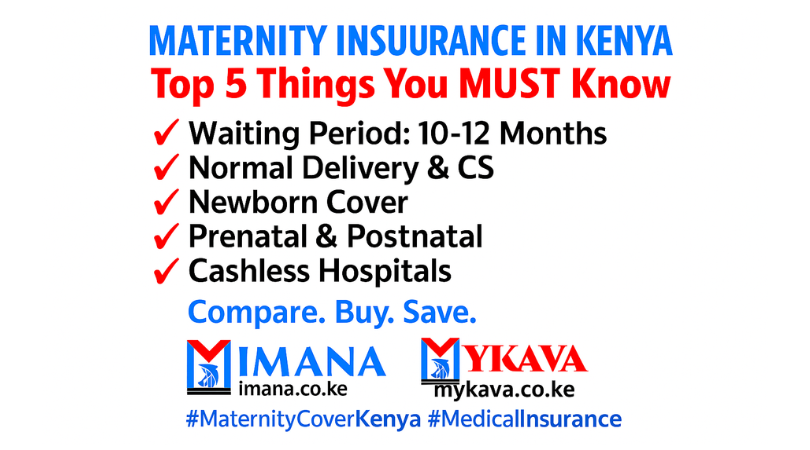

Maternity Insurance in Kenya – The Ultimate Top 5 Considerations (2025 Guide)

Pregnancy is beautiful — but the bills? Brutal.

And in Kenya, maternity costs can jump from KES 35,000 to over 300,000 depending on the hospital, delivery type, and complications. That’s why maternity insurance isn’t just a good idea… it’s a survival hack.

Before you sign up for a cover, here are the Top 5 things you MUST consider — told softly, clearly, and honestly.

1. The Waiting Period — The Silent Dealbreaker

Let’s start with the biggest truth in the room: maternity insurance is never immediate.

Every insurer in Kenya sets a waiting period, usually:

- 10 months

- 12 months

- Sometimes up to 24 months

Meaning: You need to be covered before you get pregnant.

If you’re already expecting, most covers won’t accept you — except a few high-tier corporate plans.

2. What the Cover Actually Includes — Don’t Assume Anything

Here’s where people get caught off guard.

Different maternity plans in Kenya offer different benefits. Always confirm whether your cover includes:

- Normal delivery costs

- C-section (CS) coverage

- Pre-natal & post-natal clinics

- Newborn baby cover for 30–90 days

- Complications (maternal & neonatal)

- NICU charges {Neonatal Intensive Care Unit}

- Vaccinations

Top hospitals in Nairobi — like Aga Khan, Nairobi Hospital, MP Shah, Mater, and Karen — have higher rates. So pick a limit that matches the hospital you prefer.

3. The Cost vs. Limit — Does the Math Make Sense?

Let’s be real: maternity covers differ wildly in price.

Typical annual premiums in Kenya (2025):

- KES 35,000 – 80,000 for basic limits

- KES 100,000 – 180,000 for mid-tier limits

- KES 200,000 – 450,000 for high-end Nairobi hospitals

Your goal isn’t just to find the cheapest plan.

Your goal is to avoid top-up fees at the hospital because your limit got exhausted at the worst time.

If you want delivery in major private hospitals, pick 150K+ maternity limit.

4. Network Hospitals — Where You Can Use the Cover

Not all insurance companies are accepted everywhere.

Before you commit, check:

- Does your preferred hospital accept the insurer?

- Do they allow cashless maternity admission?

- Are epidurals (anaesthetics) covered or billed separately?

- Are elective CS deliveries allowed?

Some covers only work on reimbursement for maternity. If you don’t like paying upfront, avoid those.

5. SHIF/SHA vs Private Maternity Covers — Know the Difference

With the rollout of SHA/SHIF, many Kenyans are asking whether it’s enough.

Here’s the truth:

- SHIF covers basic maternity in public facilities.

- Private insurance covers higher-quality care, private rooms, major hospitals, emergencies, and complications.

If you want a smoother, more controlled maternity journey — private insurance is still essential.

SHIF + Private Medical + Personal Savings = Stress-free pregnancy.

How to Buy Maternity Insurance in Kenya (Fast & Online)

Because honestly, no one wants to walk around offices anymore.

You can compare maternity quotes from trusted insurance companies through:

✅ Imana Insurance Agency Kenya

Free comparison, guidance, and support

https://imana.co.ke/insurance/imana-health

https://imana.co.ke/insurance/health-insurance

https://imana.co.ke/contact-us

✅ MyKava Online Insurance Shop

Fast online quotes + WhatsApp support

https://www.mykava.co.ke

Both platforms help you:

- Compare multiple insurers at once

- Understand limits & waiting periods

- Pick the best cover for your hospital of choice

- Buy 100% online

- Enjoy claims support if complications arise

Maternity Insurance Is Not Luxury, It’s Wisdom

In a world where hospital bills move faster than your salary, maternity insurance is your anchor. It’s that quiet reassurance that even if things go sideways, you and your baby are protected.

Plan early. Compare widely. Choose smart.

And when you’re ready to get covered, your lifelines are right here:

🔥 Imana Insurance Agency Kenya — Nairobi’s trusted expert

🔥 MyKava Online Insurance Shop — Instant online insurance